The long standing oil price surge has caused pain at the gas pump for drivers around the world. As you can see on the U.S. gasoline price chart from the Energy Information Administration (Gasoline prices in the U.S….), gasoline prices in America have almost doubled since January ’07. In January 1999, crude oil was as cheap as $16 per barrel. Since then, prices have been increasing rapidly, topped $100 per barrel on January 2nd, and headed to a new record of $147.27 on July 11th 2008. This extraordinary development prompted many analysts to talk about a bubble. Generally, speculators are blamed for driving up the price of petroleum unsupported by the fundamentals of supply and demand. Politicians would like to use this feeling to tighten their grip on the financial markets.

However, the price of crude oil is now down by more than 18%, trading at $119.85 today. Not even one month passed since the record high and oil prices have lost more than 27 dollars per barrel. Now, the question arises: Has the bubble popped? Should we expect a crash in oil prices? Is crude oil overvalued?

Many analysts predicted that the oil bubble was set to burst as early as 2005 when oil was traded below $60. Of course, there was a tremendous influx of money into oil futures in recent years. But those who were betting on rising prices are increasingly moving from oil futures and oilcontracts. Some experts expect even a kind of commodities sell-off. The significant decline we experienced in the matter of weeks is likely to be the result of emotional behavior rather than rational decisions. However, there are some facts that support the recent development: Demand for oil dropped in almost all industrialized countries, people are cutting back on their driving and shift away from gas-guzzlers to more efficient cars and cars using alternatives to gasoline for power (see Drivers are ready for electric cars and all other posts on that topic), Housespeaker Nancy Pelosi proposed to release some oil from the strategic oil reserves in order to lower prices at the pump, Hurricane Edoward is not threatening any major supply depots, offshore drilling is under consideration and many major economies are heading into recession or stagflation.

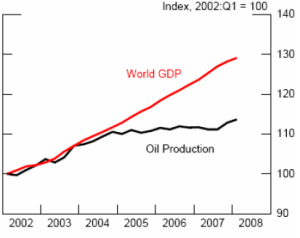

Nonetheless, we are at the beginning of an era of scarce and costly oil. Even if oil prices might dip below $100 a barrel for a while, this will be just a pause on the path to new records. First, there’s the OPEC cartel which will inevitably reduce oil production to maintain prices if they should fall too much. Second, oil is not abundant as many think, there’s no excess supply with growing demand from emerging economies in Asia and oil production will hardly manage to cope with demand.

(Experts from the Energy Watch Group say that oil production has already peaked in 2006 and will decline steadily: Oil will become even more expensive, a coming up fundamental transition – scary news) Third, lax monetary policy around the globe fueled inflation and the rise in global commodity prices. Excess money in circulation contributed decisively to the oil price spike. To maintain the value of their petroleum exports, oil-exporting nations were happy to see the price of oil going up every time when the dollar lost in value against other currencies such as the euro. And it is the fundamentals of supply and demand that justify the high price of oil. Unless the global economy heads into recession, we won’t see any lasting price decreases. There’s no speculative oil bubble, global oil reserves are at low levels, demand is close to exceeding supply and any international crisis or natural disaster will drive up the price of oil to new record levels. Iran’s OPEC governor Mohammad Ali Khatibi said: “In case the dollar continues to depreciate, and the political tensions continue to deepen, the oil price may even reach $500 per barrel.” In the event that e.g. the Strait of Hormuz, which is a strategically extremely important waterway between the Persian Gulf andthe Gulf of Oman with close to 40% of the global oil supply passing through it, were sealed off, 500 dollars a barrel could become a real scenario as global oil supplies would be affected decisively. Iran threatens to disrupt sea traffic in the case of an attack by Israel or the United States.

http://blogs.wsj.com/marketbeat/2008/07/23/has-the-commodity-bubble-popped/

http://www.presstv.ir/detail.aspx?id=64986§ionid=3510213